Notice the two words with the largest font in the above advertisement: reward and benefits. The Pottery Barn Credit Card totes numerous perks including no annual fee (I would hope not), special offers (junk mail & spam), online account management (yippee, another login…who doesn’t have this nowadays?!), and the ability to use your “rewards” credit cards at all Pottery Barn outlets (store, online, catalog…well duh). So what they’re saying is the benefits are not beneficial at all.

But what about the 12 months special financing OR the 10% back in rewards. Notice the word with the smallest font. This tiny little “or” is critical in clarifying that the two most significant rewards are actually an option between them and not both included. It’s a classic example of the ol’ strategic font size marketing gimmick. With that highlighted, let’s dive into these two reward options.

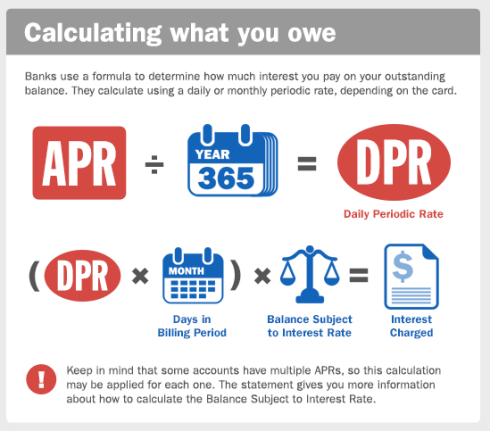

To begin, in order to benefit from the 12 months special financing, your first purchase must be at least $750. The special financing rate is 0% APR, if and only if, the entire balance is paid off within that initial 12 month period. If not (brace yourself), interest is charged on the account from the purchase date at the standard variable APR (19% or 22.8%, depending on credit worthiness). So even if you paid off all but one dollar of the initial purchase within 12 months, you would automatically be charged at least $156.89 in interest (assuming a $750 purchase at 19% over 12 months). That initial $750 purchase now costs more than $900. That’s a hefty penalty for not meeting the payment expectations.

Let’s discuss the other option, 10% back in rewards. The first important factor is rewards are only earned on purchases that are greater than $250. Not a $100 purchase nor a $200 purchase, but only $250+ purchases. Second, the rewards certificate is only redeemable at PB outlets; makes sense. But when the rewards certificate is used, if the purchase total is more than the value of the certificate, the remaining purchase balance must be payed with by using the PB Credit Card. It’s amazing this requirement is even legal. This means a customer would not be permitted to pay the remaining balance in dollars (a.k.a. US legal tender). It’s a clever way to perpetuate the use of their credit card. Finally, if the purchase is less than the certificate amount, of course, the balance of the certificate is forfeited.

So the former benefit, if paid off within the initial 12 month time period, is basically just a way to (for free) avoid paying for something up front. And the latter, if over $250 is spent on a purchase and a number of hoops are jumped through, could potentially earn 10% more PB merchandise, because who doesn’t need more PB crap. None of this seems rewarding.

Tags: annual fee, benefits, credit card, interest, reward

Now let’s look at the fine print. Standard variable APR of 19.00% to 22.80% or a APR of 26.99% – depending on when you opened your account – with no additional details or explanation. Consider that even a person with the absolute best credit score ever would get the lowest possible rate of 19.00%.

Now let’s look at the fine print. Standard variable APR of 19.00% to 22.80% or a APR of 26.99% – depending on when you opened your account – with no additional details or explanation. Consider that even a person with the absolute best credit score ever would get the lowest possible rate of 19.00%.